Are you a Small Business Owner, looking to form an S Corporation? or Are you looking to convert your existing C Corp or LLC to an S Corp?

Continue reading our step by step guide of What is IRS for 2553 and Where, How and Where you need to file and send this form for your S corporation to be considered timely filed with the IRS.

Contents

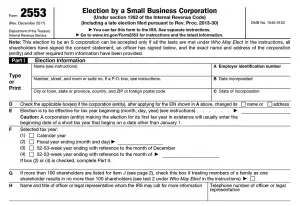

What is the Form 2553?

Form 2553 allows small businesses to register in an S corporation rather than a default C corporation. Generally businesses use the form for tax returns.

S corporations save tax dollars because their profits are only taxable once by their shareholders.

Owners on an S Corporation are required to pay personal taxes on all income and loss and pay personal rates. C corporations pay tax on corporate income and on dividend income.

Find out about the advantages that S Corp may offer to your company. We have a detailed article for S Corp.

Importance of the Form 2553?

Form 2553 is crucial in order for you to convert your C Corporation or your LLC into an S Corp. S Corporation has various tax benefits such as Self Employment Tax Savings.

Its important that you take your time to understand the requirements of form 2553 and file within 75 days from the formation of the entity. If you are unsure, we recommend working with a CPA, Tax Professional or a Business Attorney to property and timely file this form.

Who Needs to File IRS Form 2553?

In order for a business to be eligible to file for an S Corporation electing(Form 2553), the business must meet certain requirements. See the following 6 key requirements that must be met.

- The business must be a domestic entity or a corporation. This means that a Company must be based in the United States.

- All shareholders in the corporation must be US citizens or residents. This means that a Company owned by a Foreign Shareholder doesn’t qualify.

- No more than 100 shareholders.

- Shareholders can only be individuals, estates, exempt organizations, or certain trusts. In Certain Cases One S Corp can Own Another S Corp(Rules Apply).

- Corporation can only have one type(Class) of Stock. You are allowed to have Voting and Non Voting Shares but you cannot have different Class of Stocks.

- Tax year ending on December 31

Due date of Form 2553(S Corporation Election)?

In order for Election to be considered timely, S Corporation Election Form 2553 needs to be filed with the IRS within 75 days of formation of the entity.

In other words: No more than two months and 15 days after the beginning of the tax year the election is to take effect (Typically March 15)

This form(2553) can be mailed via certified mail or faxed to the IRS.

If this form is not timely filed it can have serious tax consequences. We have shared more information about S Corp Late Election(below) that can help you apply for Late Election Relief.

Where to File the IRS Form 2553?

You Can file the Form either via Fax or Via Mail. See Address and Fax Numbers Based on Where the Entity is Located.

This Information is provided per IRS Website. Please Double check by clicking on this link to verify if the address and fax number is Still Accurate.

IF the corporation’s principal business, office, or agency is located in… | Use the following IRS Center address or fax number |

|---|---|

Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Fax: 855-887-7734

|

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury Fax: 855-214-7520 |

Pro Tip If you are wondering if you can Email IRS or submit the form 2553 Online, there is no such option available at this time.

S Corp Late Election Relief

If your entity is formed 3 years or less and you want to apply for S Corp Late election relief its available under IRS Rev.Proc. 2013-30

Rules for S Corp Late Election Relief (General Rules)

The requesting Entity wanted to be treated as an S corporation, and only reason it couldn’t be a S Corp because election was not filed on time.

The requesting business entity has can can prove a reasonable cause showing why it couldn’t timely file an election.

The Business Entity filed form 1120S and all shareholders received K1s from S Corp and reported their income consistent with an S corporation

Less than 3 years and 75 days have passed since the formation of the business entity

Business Entity is an eligible entity as defined in Treas. Reg. § 301.7701-3(a)

The Business Entity failed to qualify as a corporation solely because Form 2553 and or 8832 was not timely filed

S Corp Late Election Relief under Rev. Procedure 2021-1 (Private Letter Ruling)

If you cannot get relief under Revenue Procedure 2013-30 then we recommend you look into getting a Private Letter Ruling under Rev. Procedure 2021-1.

You May need to hire a Tax Attorney, CPA or an EA who has experience with Private Letter Ruling.

How often do I need to file Form 2553?

You Only need to file form 2553 Once. IRS will process the form 2553 and will send you a letter confirming your S Corporation Status.

Once you have received the letter, you do not need to refile the form 2553 again.

What is the Filing Fee for the Form 2553?

There is NO Filing Fees that form 2553. If you hire a CPA or an attorney to fill out the form, you may need to pay them couple hundred dollars to complete and properly file the form.

How to Check or Verify an S Corp Status?

After you have mailed or faxed the Form 2553, you can check the status of your corporation by calling the IRS. The IRS is the only one that can inform you about the status of your application.

You will typically hear from IRS in about 60 to 75 days after your form 2553 is processed. If you didn’t hear back from the IRS within 60 to 75 days we recommend calling the IRS right away.

Video Tutorial

https://www.fundera.com/blog/form-2553-instructions

Conclusion

In Summary its important that you understand What the IRS form 2553 is and how and where to timely file this form. As we said earlier, if you are unsure then hire a professional to help you properly complete this form.

Furthermore, there are two different method of receiving Relief for your S Corp. First is though Rev. Pro. 2013-30 and second is though Private Letter ruling Rev Procedure 2021-1.

We recommend you learn more about S Corp and various entities and other tax strategies by clicking on Learn More below…

Learn More

S Corporation Ultimate Business & Tax Guide

Reasonable Salary for S Corp Owners

How to Tell If a Company is an S Corp or C Corp?

2 thoughts on “When How and Where to File the IRS Form 2553 (S Corp Election)”