Have you filed your taxes yet? Did you forgot to include a W2 or a 1099? Are you wondering, Will The IRS Catch A Missing W2 or 1099?

In this blog post, we’ll discuss how to handle your taxes if you forget to include a W2 or a 1099.

So without further ado, let’s get started!

Contents

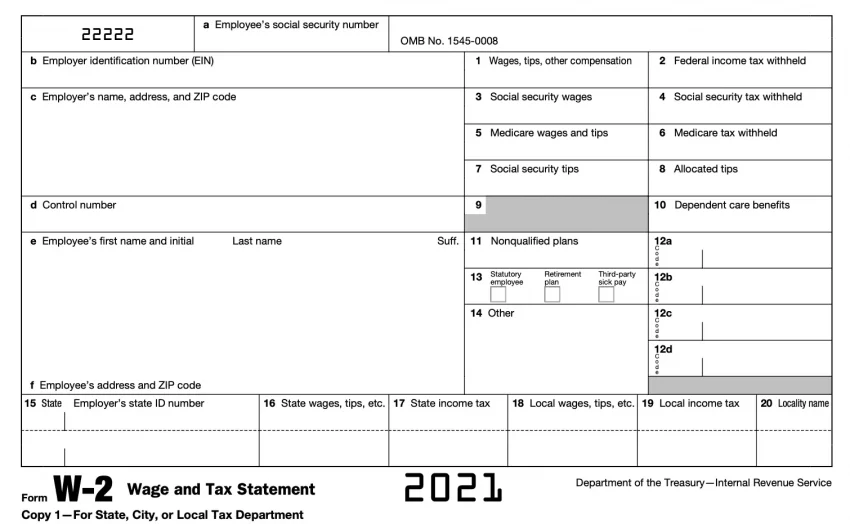

Will The IRS Catch A Missing W2

Yes. IRS will definitely catch a Missing W2.

Employer not only provide you a copy of the W2, they are also required to send a copy of the W2 to Federal Government. Hence IRS will have copy of your W2 and all your tax withholding records.

Will the IRS know if I forgot a W-2?

Can I file one of my(Missing)W-2 next year?

No you are required to file the W2 for the period you received your income in.

So if you received your income in 2022, and received a W2 for 2022, you need to file that in 2022 tax return. you cannot file that in next years tax return.

What Happens if I forgot to file one of my W2s?

If you forget to file a W2, you will receive a Notice from the IRS explaining that you missed filing a W2 and any other income such as Interest or 1099. In that case they will do the calculation and let you know if you owe more taxes or will receive a Refund.

Hence, you can simply accept that or file an amended return.

Does the IRS check every W-2?

Yes. IRS system matches your return against the information they have from employers and various other sources. So IRS system automatically matches every W2 against what’s reported by your employers.

IRS simply compares each W2 against the filing but in case of an IRS Audit, then they check each W2 and other income against what is reported on the IRS tax Return.