you ever wondered “What is My Filing Status?” There are 5 different Filing Status available when you file your personal taxes. Each Status has a set of requirements that must be fulfilled to claim the status.

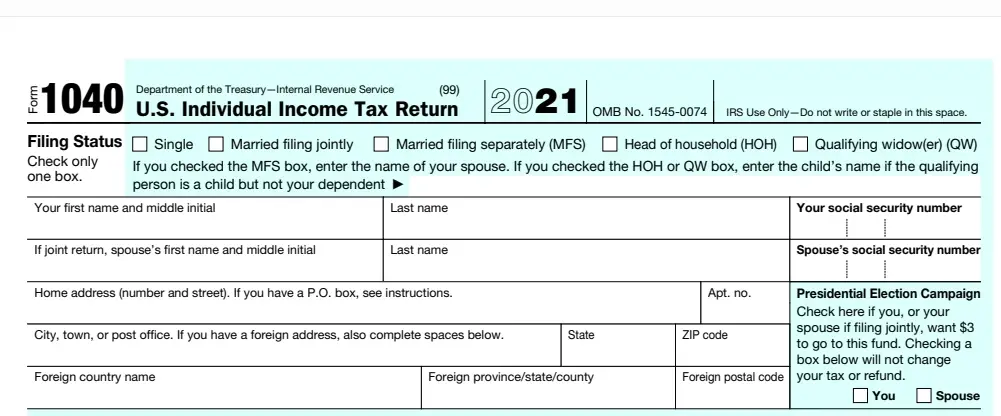

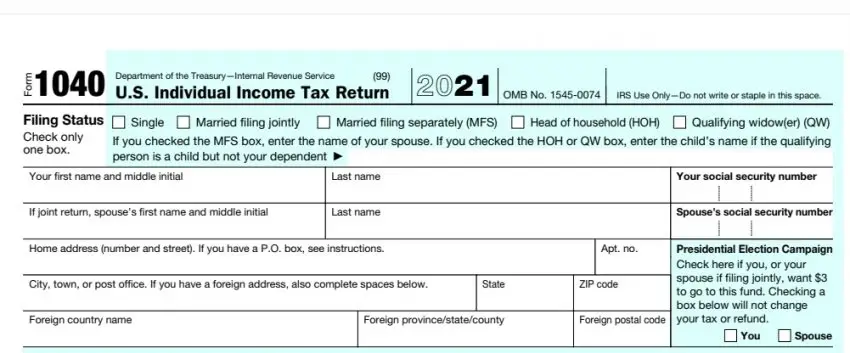

Here are 5 Filing Status that are available for you when you file your personal tax return(1040)

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er)

These filing status options are Located on the very top of the 1040, and you are required to only check one of the boxes.

Contents

Single

On Dec 31st if you are single, unmarried, your marriage is annulled or you are divorced, you are considered single for the entire year.

Most people who file single typically doesn’t have any dependent they provide more than half of support for.

Head of Household

Typically this is used by unmarried individuals who provided more than half the support for another person in the home and paid for the expenses for the home.

This can also be claimed by married personal if they are separated form their spouse for more than 6 months(2nd half of the year i.e. July 1st to Dec 31st)

Married Filing Jointly

You are considered Married for the entire year, if on December 31st you are legally married.

One important thing to consider when you file Married Filing Jointly is that you are both responsible for the tax due. If one spouse is self employed and didn’t pay their taxes, both will be responsible for the tax burden.

Furthermore, if the tax return is audited, both spouses paperwork will be checked. See how to avoid IRS audit by clicking here.

Married Filing Separately

If you are married on December 31st but don’t want to file taxes with your spouse either due to financial reasons or due to separation can use Married Filing Separately.

This tax filing status has very high tax and may end up resulting in higher taxes than filing as Single, Head of Household or Married filing jointly. Please see if any of these status applies to you before you picking this status.

Qualifying Widower

People who loose their spouse and have a dependent child that they provide more than half the support for the entire year can take Qualifying Widower Status.

This status is typically available 2 years after the death of the spouse. Please make sure you keep a copy of spouse’s death certificate that shows the date of death in case IRS has any questions. See our guide on how long you are required to keep you tax records by clicking here.

If you still need help with the correct filing Status then check out this IRS tool

Learn More>>

2 thoughts on “What is My Filing Status?”