Filing taxes is a job that nobody likes to do, but it has to be done every year. The Internal Revenue Service (IRS) doesn’t implement any real time limitations on how long you have to file past taxes.

Therefore, you can file any back taxes at any time, and the IRS won’t deny your return.

However, if you want to claim a refund for a tax year, then you do have a time limit. Thus, if you want a refund from a tax year, then you have up to three years to file that return.

In addition to that, the IRS could possibly take action against you if you do nothing after 6 years.

In this article, we will be going into more detail on how many years you can file back your taxes, and if there are any consequences.

Contents

Six Years Is The Limit

When it comes to filing your taxes, there isn’t really a hard rule that is set in place. However, the IRS would prefer that you file your taxes sooner rather than later.

Alongside that, you need to have filed your taxes for the last 6 years to be considered to be in good standing with the IRS.

However, if you want to claim a refund on your taxes for the last year, then you need to file your tax refund within 3 years.

Don’t Wait Too Long

A lot of people may think they have plenty of time, if they have up to 6 years to file their taxes. However, there may not be a definite rule set by the IRS around your time limit and taxes, but if you want too long then the IRS will get involved.

What this means is that the IRS will actually file a tax return on your behalf if you wait far too long to file your own taxes.

This can have severe consequences, as the return that the IRS sends won’t take into consideration any deductions or tax credits that you may have claimed in the past year.

In this situation, the IRS will complete a tax return for you, and it is very likely that you will end up owing more tax than you would have needed to pay.

Although, you don’t need to fret, as you are given some notice before this happens.

Normally, you will receive a Notice of Deficiency CP3219N. This notice is offering you 90 days to do one of the following things.

You either have 90 days to file your own taxes that are due, with all the credits and deductions that you are entitled to. Or you have 90 days to file a petition towards the Tax Court and argue your case.

Which Documents Do You Need To File Back Your Taxes?

When it comes to filing back your taxes, you need as many documents as possible. Consider when was the last time you filed your tax and do you still have a copy of that last completed tax return.

In addition, you need to figure out whether you still have the tax documents, including the W2’s for all the years you haven’t filed your taxes for.

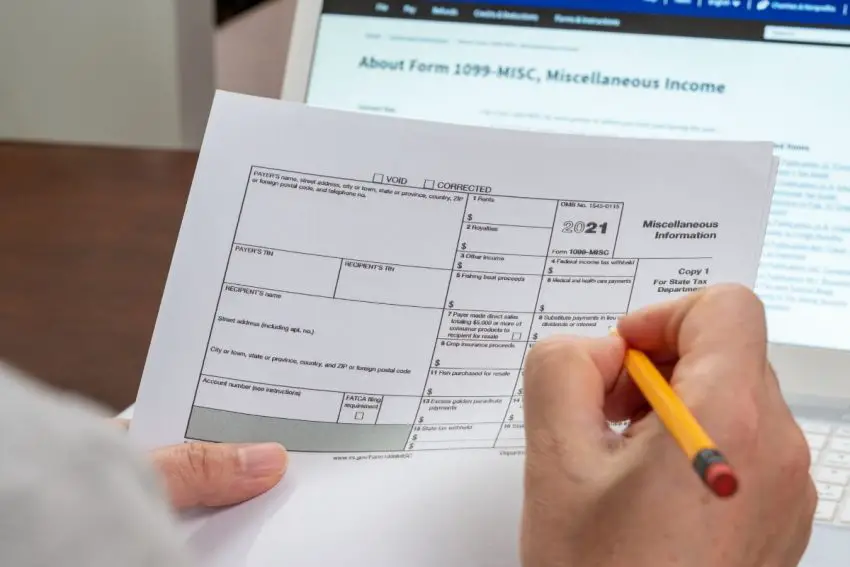

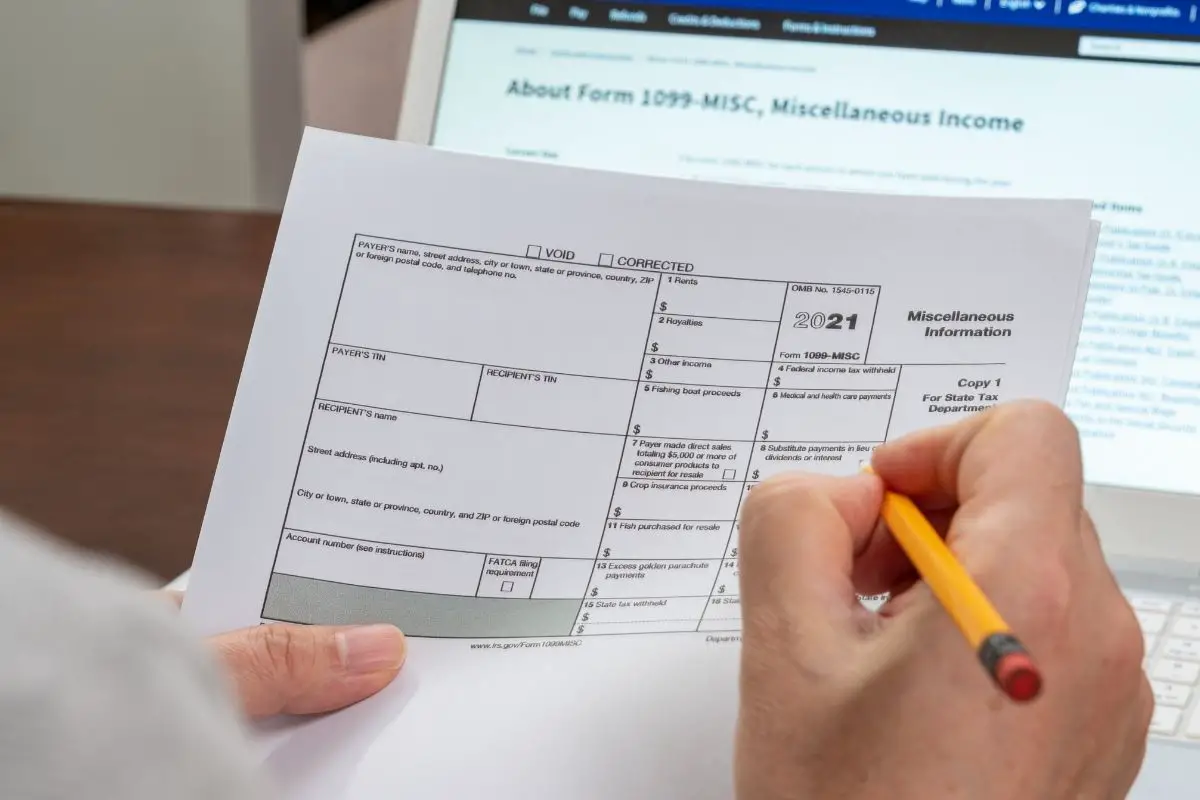

As a minimum, you are required to have the two following forms to be able to file back your taxes.

These include W2 and 1099, as both of these forms will be needed if you have acquired any form of income in the tax year you are filing for. You will also need specific tax return forms for that year.

Therefore, you can’t file using a 2021 1040 form to report income that you acquired during 2018 or 2020.

In addition to that, you will also need to make sure that you get your hands on plenty of supporting documents you can supply which will prove that you qualify for any deductible tax or tax credits.

These supporting documents could be credit card or bank statements for particular years that you are filing for.

What Can You Do If You Have Missing Documents?

For filing back your taxes for many years, then you need to make sure you have copies of as many tax documents that are relevant to those tax years as possible.

However, if you notice that you are missing certain forms or documents from particular years, then you can ask for a copy of that document from the IRS by filling out form 4506-T.

In addition, you can also get into contact with the institution or employer that had sent you those documents.

Although, it is important to keep in mind that former or current establishments or employers may not still have the documents that you require. Or they may not be able to get their hands on them as easily as they once did.

There is also a chance you may have to pay a small fee from a certain institution for these copies.

How To File Back Your Taxes?

To make this process as simple as possible, give yourself a couple of hours on every return you need to file.

In addition, use a tax program that can help make filing your taxes much easier and less stressful. However, make sure that the software is using the correct regulations for that specific tax year.

Or it may be worth hiring a professional. As they will have more experience with complicated returns and know all the regulations on how to negotiate with the IRS.

Once compiled. Print your returns out and mail them to the IRS.

Conclusion

There is no official rule, yet really you shouldn’t be filing back your taxes for the past 6 years. If you want to make a claim on any of your taxes, you have three years to file your return.

Past 6 years and you won’t be in good standing with the IRS. Also, the IRS may get involved. Thus, don’t wait to file your taxes.