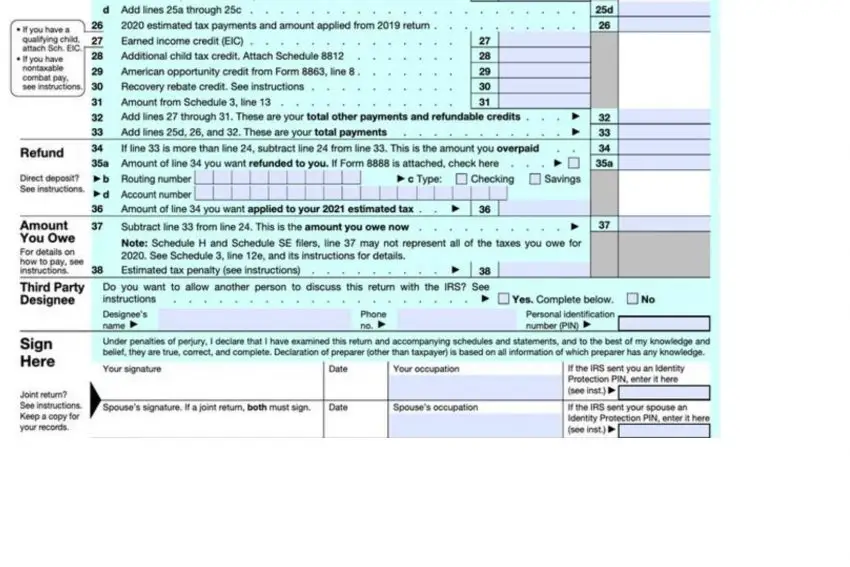

There are only 3 options when it comes to filing taxes. Either you pay taxes, break even or get a refund from the IRS. If you are getting a refund, your accountant or tax software may ask you “Do you Want to apply your refund to Next Year’s Return?” Read on to better understand your options.

Many taxpayers like receive their refund right away in their account via direct deposit or check by mail. Some choose a different path, Taxpayers can choose to apply their tax refund to next year’s estimated taxes either to the first Quarter estimated tax or spread the amount though out the year.

Contents

1 thought on “Do You Want to Apply Your Refund To Next Year’s Return?”