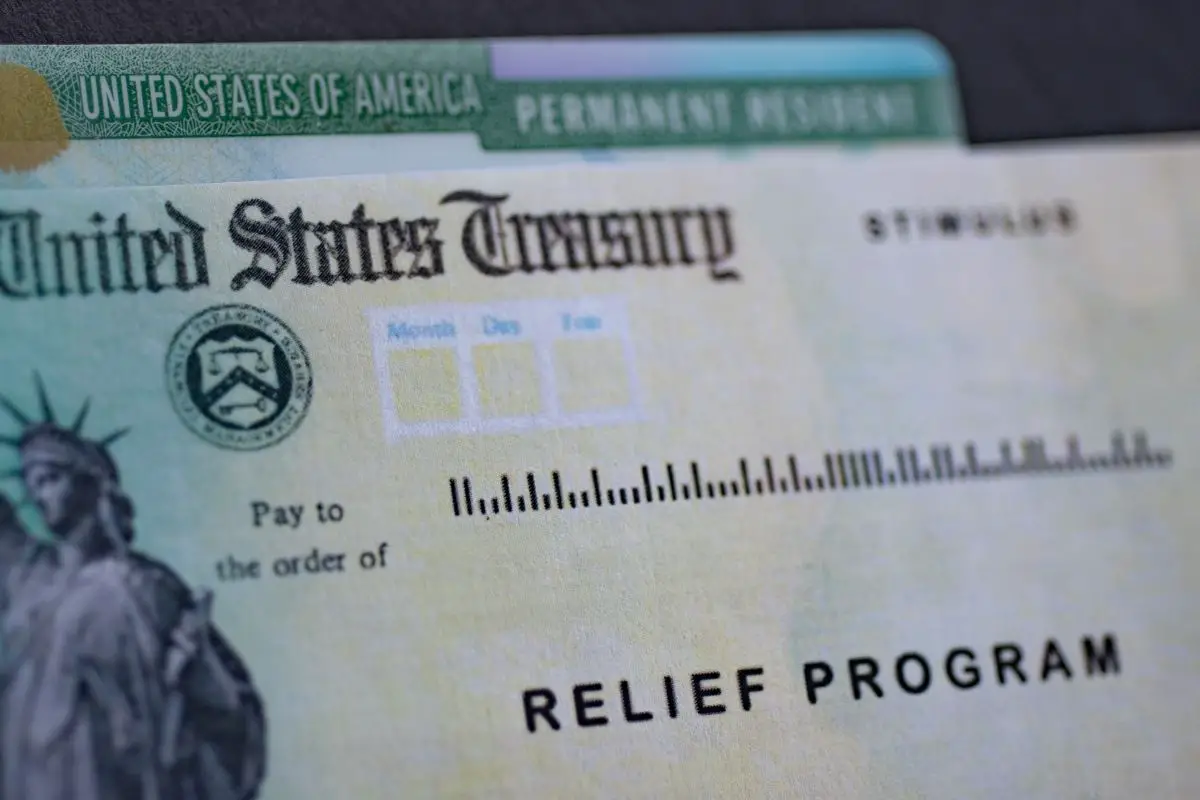

During the COVID-19 pandemic the US government has sent out stimulus payments to eligible citizens to help with the economic situation.

This payment was not intended to be paid back and was to help with coping with the increased cost of many necessities as well as how drastically the job market was changing.

Many people were losing jobs which had seemed secure, and those who still had work were working in a very different environment from what they were accustomed to.

The stimulus payment was incredibly useful and helped a lot of people significantly for the time period after it was paid.

But with this money coming in a way which people were generally not accustomed to, and in very unforeseen circumstances, people have wondered if there are any strings attached and if the money comes with any extra responsibilities.

Like any income, many people have wondered how this money will affect their taxes.

One of the most commonly asked questions about this stimulus payment is if it needs to be reported on your annual tax return and how it could affect this.

If you have any questions on how this stimulus payment affects your taxes and how you should be treating the money, this article aims to clear up any potential confusion.

This article also aims to answer any related questions about the stimulus payment to help with any other unanswered questions.

If you want to know if you need to report your stimulus check on your taxes and how this will affect your tax return, keep reading!

Contents

Will You Need To Report Your Stimulus Payment On Your Taxes?

So this is the main concern of this article, will you need to report your stimulus payment, and if you do, how will it affect your tax return?

When the COVID-19 stimulus payments were rolled out, they were decided to be classified as a non-taxable income and because of this, they do not need to be reported on the tax return of the year you got it.

Many people wonder if this money was in fact, an advance on an annual tax refund, but this is not the nature of the loan, and it does not impact your tax refund in any way.

The stimulus payment does nothing to impact your annual tax refund and will not increase or decrease the money you could owe with your taxes since it is completely separate from this amount.

For the tax year of 2021 there was an extra worksheet which was possible for some tax filers to be able to fill out, and it was with the intent to report your personal Economic Impact Payment.

However, this worksheet, and worksheets similar to it were not intended for everyone.

The IRS had advised that this particular worksheet was intended only for people who had not actually received a stimulus payment during that tax year, or for taxpayers who had gotten less than the maximum stimulus payment.

To summarize this section, due to the nature of the stimulus payment, if you received the maximum amount of the stimulus payment due to the economic standards, you will not have to report the payment on your tax return as the payment was intended to be non-taxable.

However, depending on the year, the IRS may have a worksheet for those who either received no payment, or not the maximum payment to assess economic impact.

How To Receive Additional Stimulus Payments?

There is a chance that if you did not receive that maximum payment that each person could receive, or if you were in a position where you did not receive the bonus that people who gave birth to children during this year received, there is a chance that you can fill out an additional worksheet to make it, so you can claim the extra payment which you are owed.

There are many guidelines out which can show how you specify for different levels of payments, but if you have received the original stimulus payment, you should have received a Notice 1444, usually in the mail which will show exactly how much money you were given in the first payment.

If you fill out the new worksheet to show how much you are owed, alongside Notice 1444 which will show how much you were given with the first payment.

This will make it, so you can let the Recovery Rebate Credit know if you are owed any more stimulus payments and these will usually be applied onto your tax return.

The only time this will not happen is if you owe any extra taxes.

In this case you will simply have your tax bill decreased.

If this is not the case then the extra money you are owed should be included in your tax refund payment.

How To Pay Back Any Overpaid Amounts?

There is a chance that the inverse of the previous point could be true and instead of discovering that you are owed more money, it could be discovered that you in fact were overpaid.

The stimulus payments were distributed based on your previous annual tax returns and were adjusted to your AGI as well as any defendants you may have, for example children.

So the main reason you may have been overpaid is if your AGI has significantly increased in between years putting you over the AGI threshold for receiving the full payment.

However, this is a pretty rare occurrence and because of this, and because the stimulus checks are quite a new system, there is no procedure in place for if this happens.

Currently, there is no issue with this situation, and it will just be considered an extra stimulus.

Takeaway

So now you know that stimulus payments have very little effect on your tax return and that if you were underpaid you can claim the extra to be added to your tax return, and in the rare case you were overpaid, the extra stimulus is usually ignored.