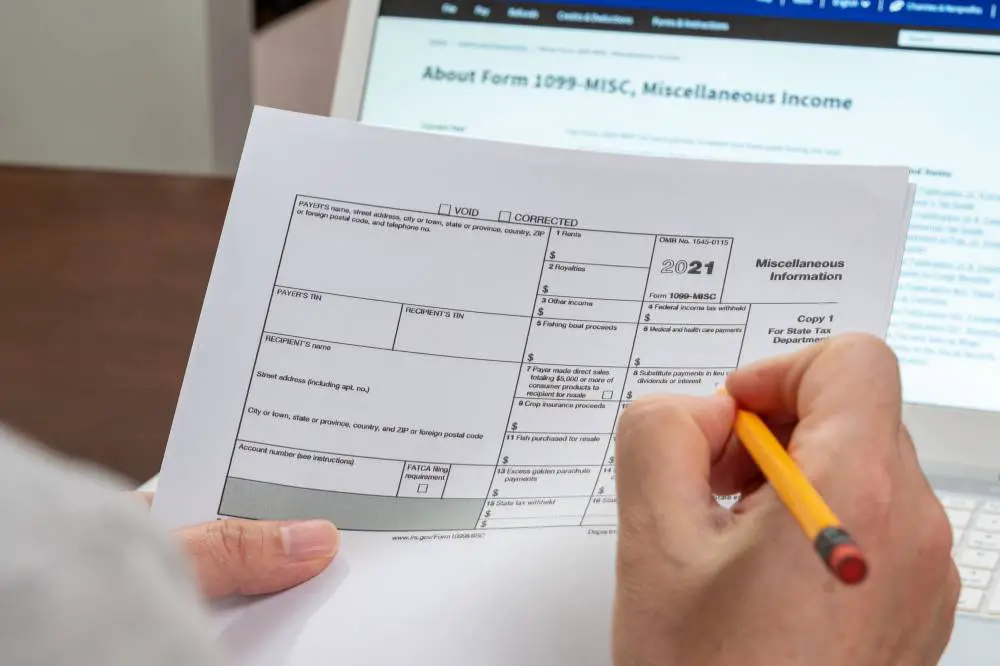

Comprehensive 1099 Guide includes Tips & Guidelines for different types of 1099s.

Learn more about 1099 filing Requirements & Due Dates by reviewing this Comprehensive 1099 Guide.

In this guide you will learn the following?

- What is a 1099?

- What is due date for 1099?

- What are different types of 1099 forms?

- Who qualifies to receive a 1099 form?

- Who are you required to issue 1099 to?

- What to do if you don’t receive a 1099 form?

- What to do if you receive a 1099 with incorrect information?

- Who is exempt from filing a 1099?

- What is W9 form used for?

- How to file 1099 with IRS?

Contents

What is a 1099?

1099 is a Tax form that is filed with IRS or sometimes with State (1099 NEC Required by State of CA) by an entity that paid you non-employee compensation such as Rental Income, Dividends. This is also called informational return that lets the IRS know what you are earning so they can verify what you report on your tax return is accurate.

What is a due date for 1099?

1099M: Businesses must send Form 1099-MISC to recipients by February 1, and file it with the IRS by March 1 (March 31 if filing electronically).

If businesses are using Forms 1099-MISC to report amounts in box 8, Substitute Payments in Lieu of Dividends or Interest, or box 10, Gross Proceeds Paid to An Attorney, there is an exception to the normal due date. Those forms are due to recipients by February 16

1099 NEC:

This form should be filed with the IRS, on paper or electronically, and sent to recipients by February 1.

What are Different types of 1099 forms?

- 1099 Misc: Miscellaneous Income

- 1099 NEC: Non-Employee Compensation

- 1099 A: Acquisition or Abandonment of Secured Property

- 1099 B: Proceeds from Broker and Barter Exchange Transactions

- 1099 C: Cancellation of Income

- 1099 G: Certain Government Payments

- 1099 K: Merchant Card and Third-Party Network Payments (Typically Issued by Merchant Credit card company such as Square to Merchant accepting credit cards.

- 1099 INT: Interest Income

- 1099 R: Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts

- 1099 DIV: Dividends & Distributions

- 1099 SA: Distributions from an HSA, Medicare Advantage MSA or Archer MSA.

- 1099 OID: Original Issue Discount

Who Qualifies to receive a 1099?

If you earned at least $600 or more from a vendor during a tax year, they can issue you a 1099. If you are an entity such as a corporation or LLC then they don’t have to issue a 1099 to you until unless you are in medical field or you are an attorney.

Who are you required to issue a 1099 to?

In General, if you paid at least $600 or more to a vendor during a tax year, you can issue you a 1099 to them. If they are an entity such as a corporation or LLC then they don’t have to issue a 1099 to you until unless they are in medical field or you are an attorney.

What to do if you don’t receive a 1099?

If you are a recipient or payee expecting a Form 1099-MISC and have not received one, contact the payor. If they don’t respond to you in timely fashion or refuse to issue a 1099s, still report correct income on your tax return using your bank statement or any other records you have available. IRS uses multiple sources to compare your income to make sure you are reporting all your income. Learn more about how to avoid mistakes and IRS audit click here

What to do if you receive a 1099 with incorrect information?

If you receive incorrect 1099 form, whether your name, address, tax ID number or amount is incorrect, contact the issuer of the 1099 right away and request a correction. If you request a correction, but the 1099 issuer doesn’t respond or don’t correct the 1099 then file correct tax return but attach explanation with the tax return. Keep record of your communication showing that you try to get it corrected in case you have to show proof to the IRS.

Who is Exempt from Filing a 1099?

You are exempt from filing a 1099 if you fulfill the following requirements:

- You are not engaged in Rental activities, a trade or business.

- You are engaged in real estate rental activities, a trade or business and

- the payment was made to another business that is setup as a Corporation C or S) or LLC or similar entity, but was not for medical or legal services or

- the total amount of all payments made to the person or unincorporated business is less than $600 in one year.

What is a W9 form used for?

W9 is used to request & provide your Social Security Number, Income Tax Identification number (ITIN) or EIN (Employer Identification Number) to the person who is requesting or required to file a 1099 with IRS.

Here are some examples when a W9 may be requested:

- Income Paid to You (1099M or 1099-NEC)

- Real Estate Transactions (1099-S)

- Mortgage Interest you Paid (1098)

- Acquisition or Abandonment of Secured Property (1099 A)

- Cancellation of Debt (1099 C)

- Contribution you made to an IRA (5498)

How to file 1099 with IRS?

You can file 1099 with the IRS either electronically or through regular mail. You can either hire a CPA or a Book keeper to file these 1099s accurately with the IRS.

8 thoughts on “Comprehensive 1099 Guide”