The business of filling out and filing taxes can be a complicated process, with lots of factors to tie into it. It can often be difficult just making sure that you pay the correct amount of tax and avoid any penalties.

However, sometimes a person will get a tax refund, which is when they have paid too much tax and are owed back some money.

With the topic of tax refunds, some people may ask the question: can I get a tax refund with a 1099 form?

We’ve got the answers for you. In the informative guide below, we’ll tell you all about 1099 forms (including just what exactly they are) and whether you can get a tax refund when you’ve received one.

Contents

Can I Get A Tax Refund With A 1099?

To begin with, let’s answer the main question. To put it simply, the answer is yes, it is possible to get a tax refund even when you’ve received a 1099 form.

It can even be the case that you get a refund when you haven’t paid any taxes on the income listed on the 1099, though this is admittedly rarer.

However, there’s more to learn about the factors and reasons that come into this, which the rest of the article will look at.

What Is A 1099 Form?

You may have been wondering throughout all this what exactly a 1099 form is. Basically, a 1099 is a form that reports all types of specific incomes that you’ve earned in the year.

All this income, however, is not an employee. Instead, it is income received as a self-employed taxpayer or as an independent contractor.

More specific examples of the income could be things such as interest that you’ve got from a bank account, or perhaps you own a stock and you’ve been paid cash dividends.

Rather than applying for it, the 1099 form will be sent to you by anyone who has paid you a minimum of $600 during the year.

Obviously, this doesn’t have to be all in one payment – for example, they may have paid you $150 one month for something, and then $450 another.

The Internal Revenue Service (IRS, who collect taxes) will receive a copy of the form too. This means that if you don’t report the form on your tax returns then they will know, and you will suffer penalties.

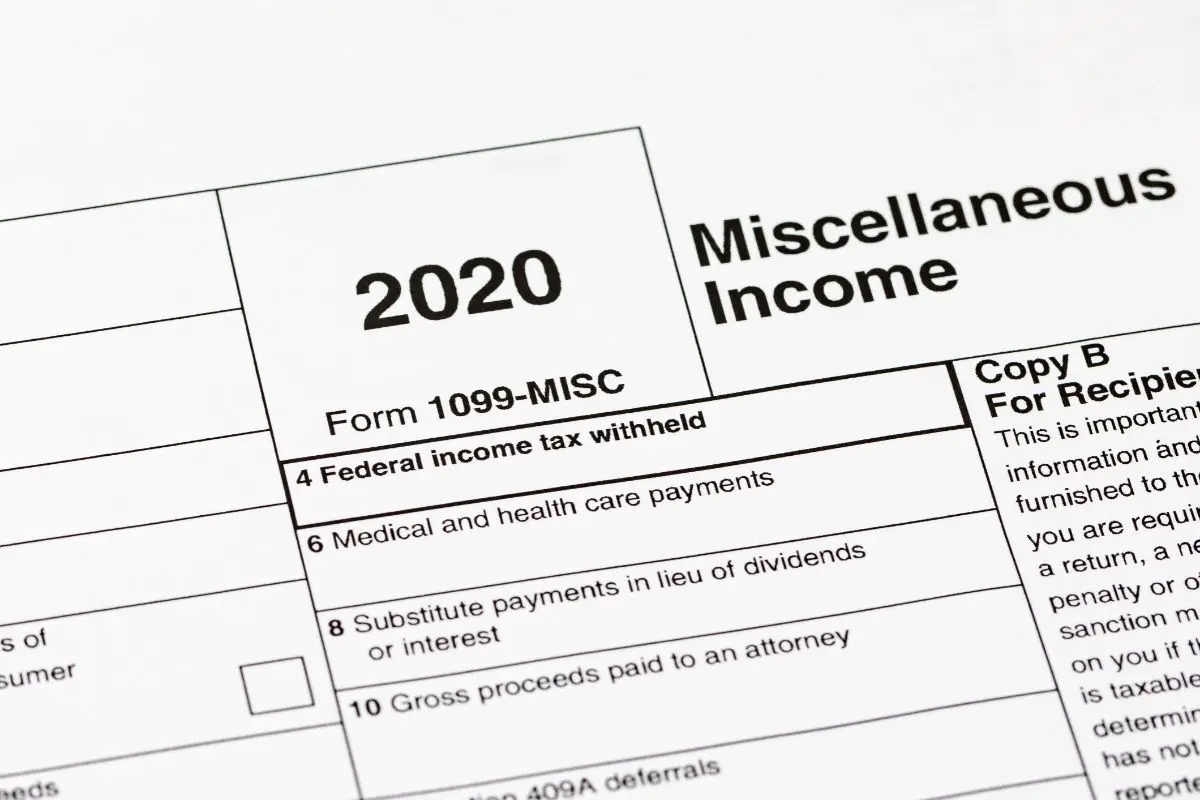

Types Of 1099 Form

There are a handful of different types of 1099 forms that you can be sent.

- 1099-MISC – the most common

- 1099-INT – for reporting income from interest

- 1099-G – for reporting benefits from unemployment, as well as local and state tax refunds

- 1099-DIV – for reporting income from dividends (stock money)

How Is 1099 Income Taxed?

If you’ve received a 1099 form for that particular type of income, then you may be wondering how the income is taxed. As we have stated, a 1099 form is given to people who are not strictly employees.

When you are an employee, your employer will often withhold taxes from your earnings and file it off to the IRS instead of you, which is often much easier than coping with the complexities of filing taxes yourself.

For this reason, 1099 form receivers will need to pass the tax money onto the IRS by yourself. This process is known as “remitting”, when you turn the money over to the appropriate tax authorities.

Specifically, the IRS wants you to remit on a quarterly basis if you’re likely going to owe over $1000 that year. Quarterly remittance means that you need to remit by specific dates for every 3 months of the year.

You will need to work out how much you’ll owe over the year, which needs to include income and self-employment tax – if the income should be going into box 7.

If you don’t do this, then you could suffer a penalty, and you will very likely not get tax refunds on it because you won’t be paying enough in the first place to overpay it.

Can I Get A Tax Refund With A 1099?

However, there are some specific cases where you may get a tax refund even when you haven’t made the quarterly remittance payments on the 1099 form income. These certain scenarios could be:

It may be the case that you have a regular job (where you are an employee) while also having this additional non-employee income that has got you the 1099 form.

While you have this regular job, you might have asked your employer to withhold some extra taxes from the money that they pay you, in order to cover the tax debt that you hadn’t been covering by making the estimated tax payments.

Now, it could be the case that this withholding amount is actually greater than the amount of tax that is due. If this is the case, then you’ll get the money refunded back to you.

Another scenario is to do with refundable tax credits. Though few tax credits are refundable, the ones that are can get rid of the tax that you owe.

When this is the case, the IRS will send you the money for any credit that has been left over. For example, you might owe the IRS $800, but realize you’re eligible for a $1200 refundable tax credit.

The credit will get rid of the $800, leaving the IRS owing you $400 in refund.

Final Thoughts

If you’ve been issued a 1099 form, for any of the different reasons that the different varieties of 1099 offer, then you may be wondering if you can get a tax refund on it.

It all depends, but in some cases you can – our guide should make it clear under which circumstances. If ever in doubt, consult an accountant.