Are you sick and tired of over paying income taxes? Have you considered Benefits of Year Round Tax Planning to save taxes?

In this article, we will be sharing with you why Tax Planning is important and how doing that year around can help save you thousands of dollars in taxes.

Contents

What is Tax Planning?

Year Round Tax planning is a process where you regularly review your financial and tax decisions to see if it is aligned with your yearly tax and financial goals. As the year progresses and you monitor your income and expenses, you can make adjustments that will have impact on your tax bill.

If you’re filing an personal tax return form 1040, you need to understand how major life events like getting married, having children, unexpected job loss, a new side gig or business, or a change in home ownership will change your financial and tax situation.

As a small business owner, this attention to cash flow is very critical. You don’t want to realize the end of the year that you made significantly more and then how you owe large amount of money that you don’t have.

Year-round tax planning gives you the control and helps you be less stressed. It allows you to understand what you can change during the year and looking ahead and anticipating what could happen.

Why is Tax Planning Important?

Tax planning is important as it allows you to pause and reflect on your financial decisions. It allows you to implement strategies during the year that can help you save thousands in taxes. It also helps you with cash flow planning. You don’t want to be in January and spent all your money in previous year and now you dont have any money to pay for income taxes or for important expenses.

How Do You Plan for Taxes?

Year Round Tax Planning should be weaved into every financial or business decision you make and in every strategy company has. Tax Planning doesn’t mean sitting down once a year with accountant and asking few questions.

In order to do successful tax planning its important you focus on

Tracking, Organizing, Learning and Improving

Lets Learn How Each one is Work and how to benefit from each

Tracking & Organizing

Consider using a financial software program or website, or at least Excel. If you’re filing individually, you can start tracking your income and expenses in a free service like Mint or pay to use, for example, Quicken or Simplifi. These applications allow you to import transactions from your financial institutions, categorize them so you know what is tax-related, and run reports that can help you in your tax preparation.

Develop a manual system for organizing your taxes. If you don’t want to go digital, visit an office supply store and invest in suitable paper or a ledger book, file folders, and anything else that you can dedicate to only tax-related documentation. Keep all receipts in one place. It is not only important to keep records for tax purpose but also to prepare for any potential audit.

If you want to learn how to avoid an IRS audit click here to learn some tips.

Learning

Stay on Top of Tax Law Changes. Tax law changes are reported in newspapers and magazines, on websites, and on television news. Pay close attention, especially to those that will affect you.

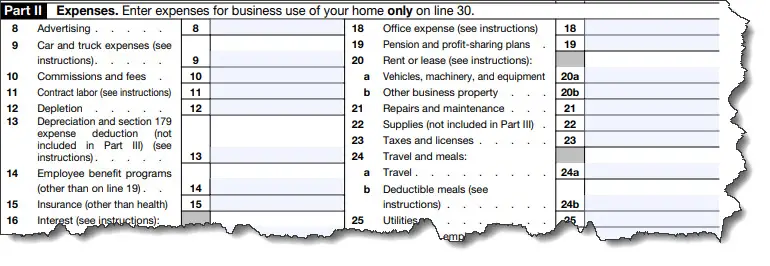

Look at IRS Tax Forms. If you’re taking on a side gig or starting your own small business as a sole proprietor in 2021, you’re going to want to acquaint yourself with the IRS Schedule C. You can look at the 2020 version now to see what information you’ll have to supply. Pay close attention to the types of expenses that are deductible and track them carefully. You might even look at the instructions.

Read Blogs. Read blogs such as www.taxsaversonline.com to learn more about tax laws and tax strategies to help lower your tax burden.

Improving

Change W2 withholding if necessary. If you’re a W-2 employee and you’re getting large refunds or paying huge amounts at the end of the year, talk to your HR at work about changing the number of allowances you claim. Refunds are nice, but you could be putting that money to use yourself during the year.

Similarly if you pay large amount at the end of the year, you may be subject to interest and penalties if you don’t pay enough during the year.

Consult with a Tax Professional. This is an especially good idea if you’re starting a new business this year and/or you’ve experienced life changes such as marriage, children or significant increase or decrease in income, that could affect your taxes.

A good Tax help you come up with a plan to prepare for tax filing throughout the year. With that in hand, we’d also be happy to do your tax preparation for you when the time comes. Contact us, and we’ll schedule some time to meet.

Tax Planning Strategies

In order to enjoy the “Benefits of Year Round Tax planning” you should meet your accountant Quarterly to review your tax information, learn more about the new tax law changes and how you can implement those in your life.

Here are examples of questions you should be discussing with your CPA or Tax Accountant:

- Whether or not to purchase or lease a business vehicles

- Whether or not to start a retirement plan such as 401k, SEP IRA or Profit Sharing

- Whether or not to employ your children in your business

- Whether or not to pay for employees bonus this year or next year

- Is it wise to pay for equipment this year or following year?

- How to take advantage of available tax credits?

- Start paying estimated taxes on time to avoid interest and penalties. Remember, money saved is money made.

These tax planning strategies can help you uncover many tax benefits and savings. Start using these strategies and start keeping money in your pocket and not in Government’s pocket.

1 thought on “Benefits of Year Round Tax Planning”