Taxpayers in the U.S. pay an average of $15,322 each year to the IRS. Doing taxes can be a tricky endeavor indeed, particularly if your financial situation is more complicated than simply having a W-2 job.

It’s essential to pay the right amount in taxes in order to escape severe consequences. However, no one wants to pay more taxes than they have to. On top of that, the complexity of the tax filing system makes it possible for individuals to make mistakes on their returns, only to realize this after the fact.

If you made a mistake on last year’s taxes or have had circumstances change that impact a previous tax year, you aren’t out of luck. You can make a tax amendment to previous returns for a number of reasons.

Are you wondering what you need to know about amending your income tax return? Let’s take a look at some of the frequently asked questions about amended returns.

Contents

What Is an Amended Tax Return?

An amended tax return is a type of form that you can file to correct a previous year’s tax return. You can claim a more advantageous tax status or correct errors with a tax amendment. For example, you might make a tax amendment if there was a misreporting of tax credits or earnings.

You don’t have to file an amended tax return to fix mathematical errors, though. This is because mathematical errors are corrected automatically by the IRS when they process your tax return.

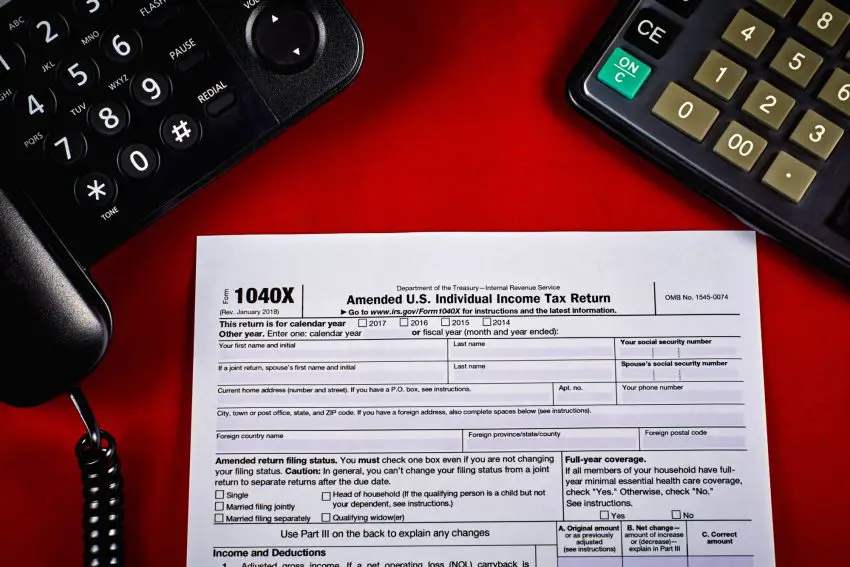

The form that you use to file amended returns is Form 1040-X. You can find this form on the IRS website.

Tax refund checks have a three-year statute of limitations, meaning you’re out of luck for previous years’ refunds after three years.

Who Should Make a Tax Amendment?

Everyone who is a taxpayer must annually file their taxes for the preceding year. Individual circumstances may have changed after they sent their return in or they might only realize they’ve made a mistake after the fact. For this type of situation, the IRS offers a way for people to redo their taxes.

As stated above, this is known as a tax amendment. The process can be completed using Form 1040-X.

If there is a mathematical error on your tax returns, the IRS will automatically make the adjustment. If you owe more money, you will be billed the extra tax liability. If you’re entitled to more money, your refund will be adjusted.

You will receive a letter requesting any missing schedules or forms that should have been included in your tax filings but weren’t.

When Is the Right Time to File an Amended Return?

There are a number of reasons a taxpayer might need to file an amended return. Let’s take a look at the different circumstances where this might be the case.

Incorrect or Changed Taxpayer Filing Status

If you incorrectly entered your filing status or your filing status changed, you will want to file an amended tax return. For example, if you got married towards the end of the tax year but filed as single, you will want to amend your taxes and file using the appropriate status. Depending on your situation, this might mean married filing separately or married filing jointly.

Incorrect Tax Credits and Deductions

If you didn’t claim tax credits and deductions or they were incorrectly claimed, you can file an amended tax return. This might happen if you realized that you qualified for a deduction or a credit that could have been advantageous to your financial situation.

(Do you operate a small business and are unsure which forms you need? Take a look at this guide for more info.)

Inaccurate Number of Dependents Claimed

If you indicated the incorrect number of dependents, you will want to file an amended tax return. If you need to remove dependents that you previously claimed or add additional dependents, a tax amendment is in order.

This might happen if you had a baby in February before you filed taxes the previous year. If you incorrectly claimed that baby as a dependent in the previous tax year, you will want to file an amendment.

Legislation Changes

It’s possible that the deductibility of certain expenses could change if there are changes in legislation. You might have already filed your tax returns for the previous year, only for there to be legislation that comes through after the fact.

Incorrect Income Reported

If you realized that you reported your income incorrectly for the previous year, you can also file a tax amendment. Maybe you received more tax documents after you have already paid your taxes, for example. In order to report the additional income and stay above board with the IRS, you can file an amended tax return.

Incorrect Amount of Money Paid

It’s possible that you are realizing that you should have paid more money than you did at tax time. If that’s the case, you can file an amended tax return. The most compelling reason to do this is to avoid receiving financial penalties from the IRS.

Tax Relief Due to a Natural Disaster

Your tax liability can change if you were impacted by a natural disaster. This can be particularly relevant if a natural disaster affected you towards the end of the tax year. It is common for the government to offer tax relief to people who are impacted by natural disasters.

That being said, it can take longer than the normal tax season for legislation to catch up to this need. It is best to pay your tax bill in full when it’s due. You can then keep an eye out for changes in legislation regarding the natural disaster that occurred.

If legislation passes that would change your tax bill, you can file an amended tax return. You can then reclaim any refund that might be owed to you as a result of the tax relief due to a natural disaster.

(Are you selling a house and wondering whether or not you have to pay capital gains tax on the sale? Check out this article to learn more.)

How to File an Amended Tax Return

There are three columns to Form 1040-X. The columns are titled A, B, and C.

Column A is where you can put the amount of money that you reported in your incorrect tax return. In column C, you will put the correct or adjusted number. Column B is where you can record the difference between column A and column C.

When you make adjustments to your taxes, the result will either be no tax change, a balance due, or a tax refund.

It’s also required of you that you explain what the changes are that you’re making to your taxes. You will also have to explain why you are doing this. The section for inputting your explanation is on the back of the form.

Amended Returns: Is It a Good Idea?

There can be some drawbacks to making a tax amendment. One downside is that you aren’t able to do this electronically for every year. As of now, the IRS accepts amended returns that are e-filed for the tax year 2019.

This means that for other years you have to manually fill out the form and mail it to the IRS Service Center that was responsible for processing the original return. It can take sixteen weeks or longer for the IRS to manually process tax amendments.

It is particularly likely to take longer if the return:

- Is incomplete

- Is not signed

- Requires additional information

- Has errors

- Has to go to a specialized area of the IRS

- Needs IRS bankruptcy department clearance

- Is impacted by identity theft or fraud

It’s important to understand that there is a three-year statute of limitations when it comes to getting tax refund steps. You will therefore want to file any amended returns within three years. Also you need to understand that there is high likely hood of an IRS Audit, if you file an amended return.

Is a Tax Amendment the Right Choice for You?

As you can see, there is a system in place for making a tax amendment if you need to. Whether your circumstances have changed or you realized you made a mistake on a previous return, the process of amending your income tax return can allow you to fix incorrect or no longer relevant information.

If you’ve already filed an amended tax return and you’re wondering where your refund is, there is a way to find out. You can either use the IRS website to track the progress of your amended return or you can call them directly.

However, it’s worth knowing that it can take up to sixteen weeks for the IRS to process the return you’ve amended. On top of that, it can take three weeks for the return to even appear in the IRS’s system. It’s best to wait sixteen weeks before talking to someone at a local IRS office or calling the IRS about your return.

Now that you have read our article “Tax Amendment: What Is an Amended Tax Return?” click on learn more below and continue reading more articles to enhance your knowledge related to taxes and how you can save more.

Doing taxes isn’t anyone’s idea of a good time, but it’s a necessary obligation as a citizen of the U.S. If you’re looking for more resources to help you navigate the U.S. tax system, check out our library of resources on the topic.

Learn More

How to Save Money on Taxes for Families in 2022

The Complete Guide to FICA and Medicare Taxes: Everything to Know

1 thought on “Tax Amendment: What Is an Amended Tax Return?”